I have been a small business owner for almost 8 years now and it wasn’t until last year where I really started to get organized with my money, and tracking business expenses, deductions, etc. I always waited until the very last minute to get everything together and, in all honestly, probably missed out on a ton of things I could have written off because of that. So, I made the decision to stay on top of my tax-prep this past year so when tax season rolled around I wasn’t under pressure like I had been in years past.

College completely underprepared me for the reality of adult finances, let alone the financial day-to-day tasks of running multiple small businesses. Between the boutique, the Whitney Rife brand, and having multiple employees for each… even though I had been organized and prepared this year I still didn’t know what to DO with all my information.

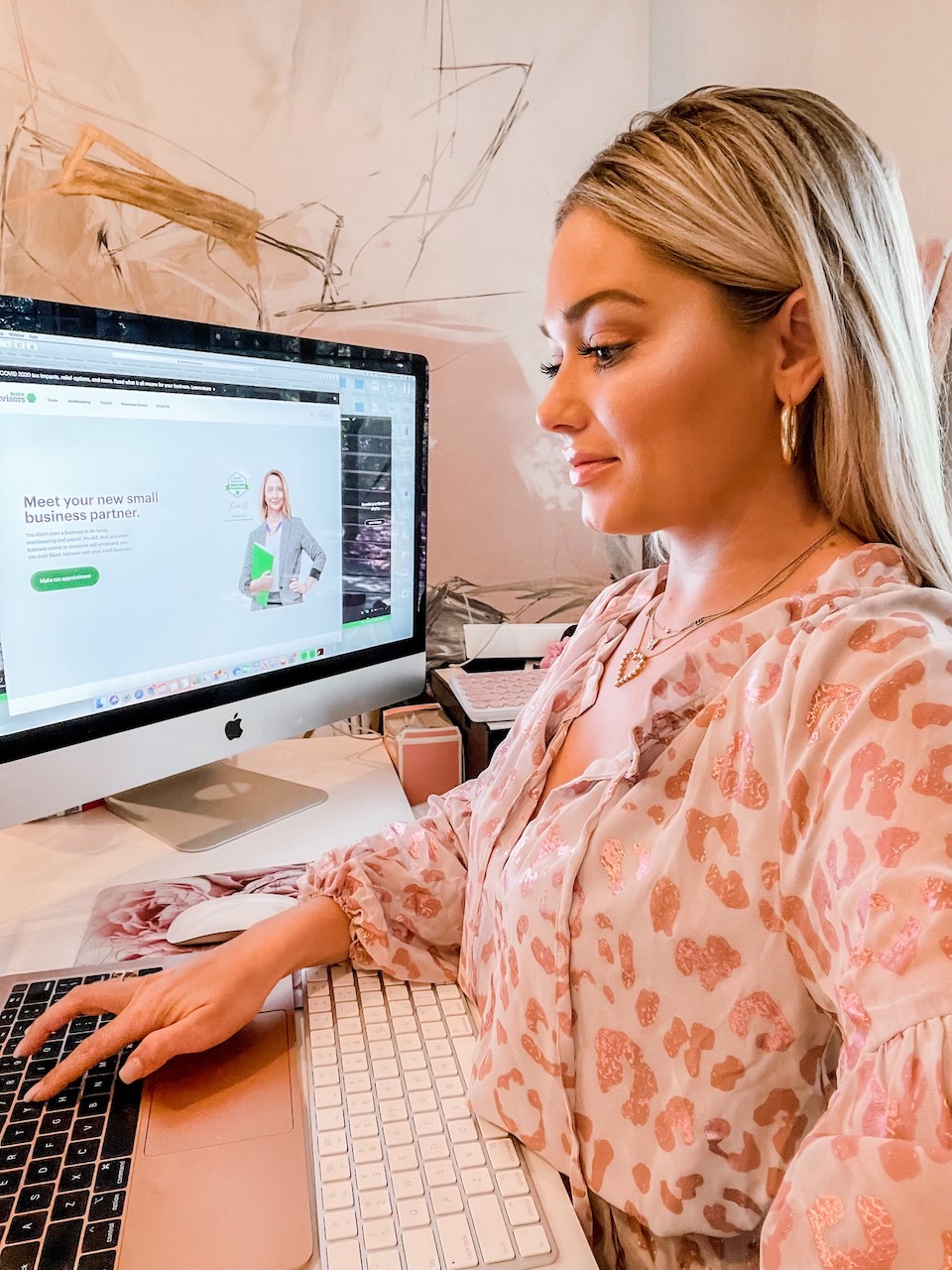

This is where Block Advisors came in to save the day. They are available year-round for small business owners and can assist with everything from bookkeeping and payroll to even offering financial advice! Pretty much making all of my financial management dreams come true. So I can focus on what I really need to do to run my business and the professionals at Block Advisors can handle the financial tasks.

Block Advisors will connect you with a Block Advisors small business certified* tax professional with an average of 12 years’ experience who will not only help you with your 2020 small business taxes, but also put a financial lens on your small business (if you so choose), guiding you to the best outcomes.

I love having a financial professional in my corner that I can trust for advice and it is such a weight off my back to know that someone that truly knows what they are doing is able to handle things I’m, truthfully, not comfortable with doing myself.

*A special thanks to H&R Block for sponsoring this post. All thoughts and opinions are my own.